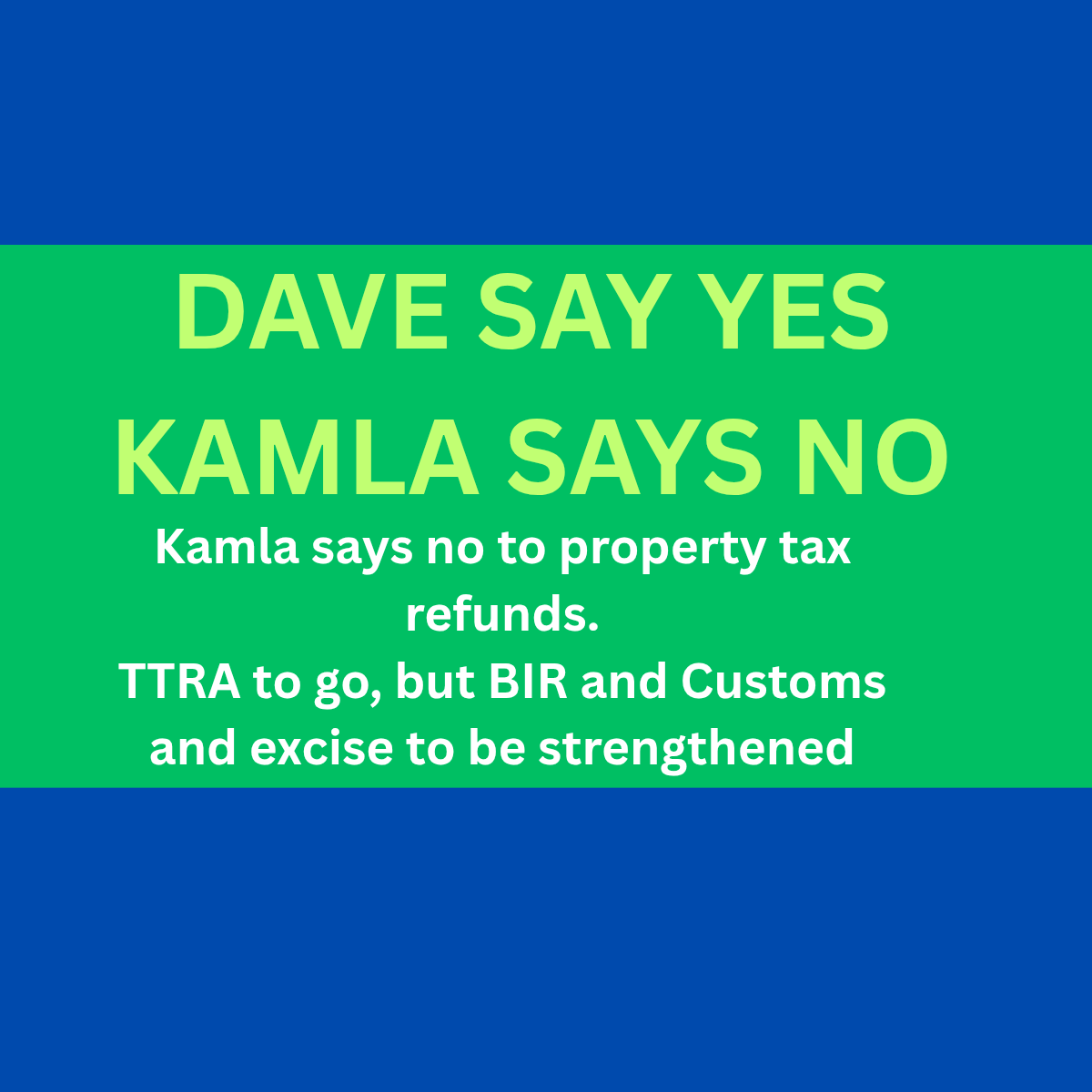

Prime Minister Kamla Persad-Bissessar has confirmed that there will be no refunds for property tax payments already made, despite earlier statements by Finance Minister Davendranath Tancoo suggesting otherwise. At a post-Cabinet press conference, Persad-Bissessar clarified that she had never promised refunds and questioned where the funds for such reimbursements would come from, highlighting the financial constraints faced by the government.

While the Prime Minister reaffirmed the government’s commitment to repealing the property tax, she emphasized that the process would take time to implement through legislative changes. She reiterated her administration’s longstanding opposition to the property tax in its current form, citing principles of fairness and economic burden on citizens.

In a significant policy shift, Persad-Bissessar announced the government’s decision to dismantle the Trinidad and Tobago Revenue Authority (TTRA), labeling it as “not functional.” The TTRA, established by the previous administration, aimed to consolidate the Board of Inland Revenue (BIR) and the Customs and Excise Division into a semi-autonomous entity to enhance tax collection efficiency. However, the Prime Minister criticized the TTRA for its potential to politicize tax administration and compromise citizens’ privacy, asserting that revenue collection should remain a core state function under direct government oversight .

The decision to scrap the TTRA has been welcomed by labor unions, particularly the Public Services Association (PSA), which had opposed the authority’s formation due to concerns over job security and lack of consultation. PSA President Felisha Thomas described the move as a “breath of fresh air,” expressing relief for workers who feared job losses and diminished working conditions under the TTRA framework .

As the government moves forward with repealing the TTRA Act, attention now turns to strengthening the existing BIR and Customs and Excise Division. Persad-Bissessar emphasized the need to empower these institutions with the necessary tools and authority to effectively collect revenue, though specific strategies for achieving this have yet to be detailed.

The repeal of the TTRA and the decision against property tax refunds mark significant shifts in Trinidad and Tobago’s fiscal policy landscape, reflecting the new administration’s priorities and approach to governance. As these changes unfold, stakeholders and citizens alike will be watching closely to assess their impact on the country’s economic stability and public service delivery.